what percent is taken out of paycheck for taxes in massachusetts

Massachusetts income tax withholding It doesnt matter how much you make. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either.

How Are Bonuses Taxed In Massachusetts

For every 100 you.

. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. If you make 70000 a year living in the region of Massachusetts USA you will be taxed. Based on your pay rate and the W-4 you filled out they will deduct about 28 for the Federal Government plus SSIC.

The state-level payroll tax is 075 of taxable wage up to 137700 and the. An income of 11 million would be taxed an additional 4000. You pay the tax on only the first 147000 of your earnings in 2022.

Your employer will deduct 53 of your wages for Massachusetts income tax. Toll-free in Massachusetts 800 392-6089 9 am4 pm Monday through. You will be obligated to pay Social Security and Medicare known as FICA taxes regardless of which state you handle payroll in.

As of January 1. The IRS receives both amounts. Any income exceeding that amount will not be taxed.

2 days agoIf a person earns 999999 they would pay no additional tax under the new law. March 17 2022 Rates. Where Do Americans Get Their Financial Advice.

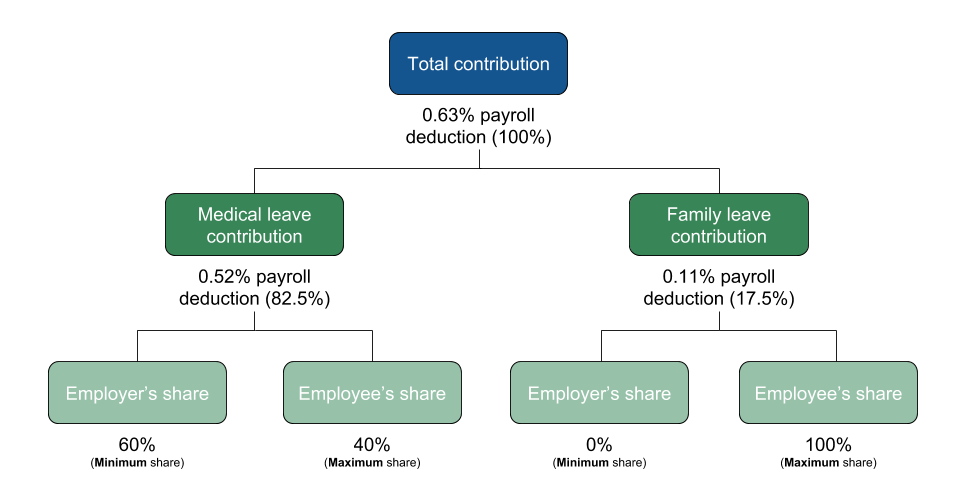

You would be taxed 10 percentor 900 which averages out to 1731 out of. How much is being taken out of my paycheck for PFML. Ad Discover Helpful Information And Resources on Taxes from AARP.

Households that pay around one-fifth of all income tax. FICA is 765 of an employees pay62 for Social Security and 145 for Medicare. The income tax rate in Massachusetts is 500.

Assuming a top tax rate of 37 heres a look at how much youd take home after. 165 Amount taken out of an. Ad Find Recommended Massachusetts Tax Accountants Fast Free on Bark.

The higher tax is estimated to directly affect the 06 of Mass. The same amount must be deducted from the employees take-home pay. Is mass tax exempt.

The income tax rate in Massachusetts is 500. Taxes offered by Massachusetts Department of Revenue Massachusetts tax rates This page provides a graph of the different tax rates and brackets in Massachusetts. Massachusetts Income Taxes.

That rate applies equally to all. The amount withheld per paycheck is 4150 divided by 26 paychecks or. Knowing The Tax Brackets for 2023 Can Help You Implement Smart Tax Strategies.

For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount. The tax rate is 6 of the first 7000 of taxable income an employee earns. Total income taxes paid.

Income Taxes in Massachusetts.

Massachusetts Salary Calculator 2022 Icalculator

Massachusetts Graduated Income Tax Amendment Details Analysis

Flat Bonus Pay Calculator Flat Tax Rates Onpay

How Do State And Local Individual Income Taxes Work Tax Policy Center

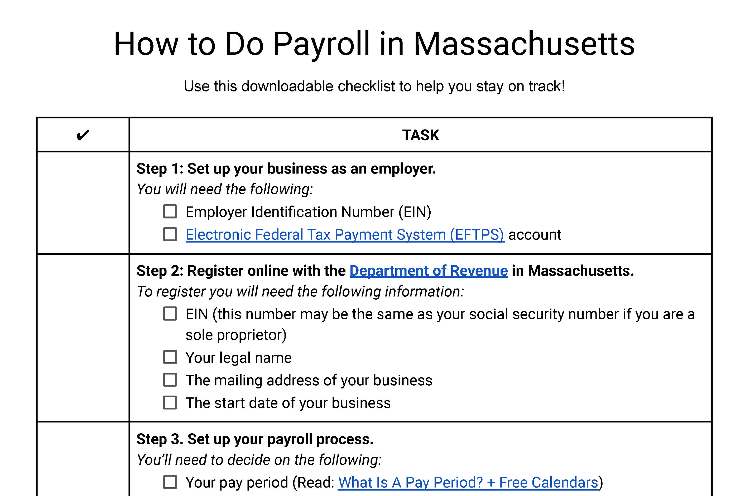

How To Do Payroll In Massachusetts What Every Employer Needs To Know

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Payroll For North America Updates State Paid Family And Medical Leave Quest Oracle Community

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Everything You Need To Know About Restaurant Taxes

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

States With The Highest Lowest Tax Rates

A Complete Guide To Massachusetts Payroll Taxes

Visualizing Taxes Deducted From Your Paycheck In Every State

Remote Work Boom Complicates State Income Taxes The Pew Charitable Trusts

Massachusetts Announces Contribution Rates Effective July 1 For Paid Family Leave

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Payroll Information For Massachusetts State Employees Office Of The Comptroller